Hiring Capacity Forecast: Funnel Throughput vs Interviewer Supply

A finance-grade way to predict monthly hires from verified funnel flow, interviewer hours, and review capacity.

If you cannot name your bottleneck stage weekly, you are not forecasting hiring capacity. You are hoping.Back to all posts

The month your hiring forecast broke in public

It is the Q-end staffing review. You have already communicated a hiring ramp to the board. Mid-month, the business expects acceleration, but the only thing that accelerated was funnel noise: more applicants, more unverified profiles, more scheduling churn. Then a fraud spike forces additional checks before interviews. Interviewer calendars were the real constraint, but the meeting turns into "why did finance not see this coming?" The fix is to treat hiring like a constrained system. Your monthly hires are the output of the tightest constraint, and constraints move when verification policy and interviewer supply move.

Why this matters to CFO and FP&A: variance, risk, reputation

Three failure modes show up in finance reviews: (1) assuming applicants equal capacity, (2) ignoring interviewer supply, and (3) treating fraud controls as a side workflow that does not affect cycle time. Pindrop reports that 1 in 6 applicants to remote roles showed signs of fraud in one real-world pipeline. Directionally, that suggests your remote funnel can contain enough noise to consume reviewer time and create scheduling waste. It does not prove the same prevalence in your stack, role mix, or region, but it is a strong signal that fraud pressure is operational, not theoretical. For cost framing, SHRM notes replacement cost can be 50-200% of annual salary, depending on role. Directionally, that means a single bad hire can erase the savings from "speed at all costs." It does not prove your replacement cost will be in that range, but it is a reasonable planning band for risk discussion.

Vanity metrics: applicants, resumes ingested, interviews scheduled

Quality metrics: qualified and verified candidates, completed interview loops, pass rates with integrity checks

Leading indicators: verification pass-through, no-show rate, interviewer hours committed, manual review queue age

Lagging indicators: offers accepted, starts, 90-day attrition

Build a bottleneck-based hiring capacity forecast

Candidate-side throughput: how many "verified qualified" candidates you can feed into interviews.

Interviewer-side supply: how many interview loops you can actually run given available hours. Do this per job family or level. Aggregating too early hides the constraint. One team will be interviewer-limited, another will be verification-review-limited.

Stages: Applied -> Verified -> AI Screen Completed -> HM Screen -> Panel -> Assessment -> Offer -> Accept

Normalize all events to one timezone and one candidate identifier (IntegrityLens candidate id mapped to ATS person id)

Use idempotent webhook ingestion to prevent double counting stage events

Use rolling 4-8 week windows to compute stage-to-stage conversion (p) and median cycle time (t)

Break out the verification stage: pass, fail, and manual review outcomes

Track queue age for manual review as a leading indicator of reviewer fatigue

Collect interviewer availability hours per week by function and level (net of PTO, on-call rotations, known launches)

Compute hours per interview loop (example: HM screen 0.5h + panel 3.0h + debrief 0.5h = 4.0h)

Slot supply = available interviewer hours / hours per loop

Apply no-show and reschedule factor based on last 4-8 weeks

Verified qualified per week = applicants * qualified rate * verification pass-through

Subtract the portion stuck in manual review if review SLA is breached

Include AI screening capacity (24/7) as a throughput stabilizer when recruiter bandwidth is constrained

Start with the bottleneck stage each week (often interviewer loops)

Multiply by downstream conversion: loop complete rate * assessment pass rate * offer accept rate

Recalculate weekly and track variance drivers: interviewer cancellations, verification review spikes, assessment integrity flags

A capacity forecast query Finance can audit

This SQL sketch is designed for a warehouse that receives ATS stage events plus IntegrityLens verification outcomes. It produces a weekly view of candidate throughput, interviewer slot supply, and a bottleneck-based hire forecast. Replace table and field names with your schema.

Risk: Fraud controls change capacity (plan for it)

Fraud pressure is not just a Security topic. It consumes interviewer time (wasted loops), recruiter time (reschedules), and review time (manual checks). When fraud attempts rise, your capacity forecast should degrade gracefully, not fail silently. Treat verification and fraud detection as a gating function that produces "verified qualified" supply. If you loosen it to hit a target, document the exception and capture Evidence Packs so you can defend decisions later.

Verification fail rate and step-up rate changing week-over-week

Manual review queue age and rework rate (false positives drive fatigue)

Interview no-show rate spikes after verification friction changes

Anti-patterns that make fraud worse

- "Just get them on the calendar" before identity verification, creating wasted interview loops when identity fails later. - Allowing untracked exceptions (email approvals, spreadsheet notes) that bypass Evidence Packs and invite audit findings. - Over-indexing on applicant volume while under-staffing manual review, which drives inconsistent decisions and reviewer fatigue.

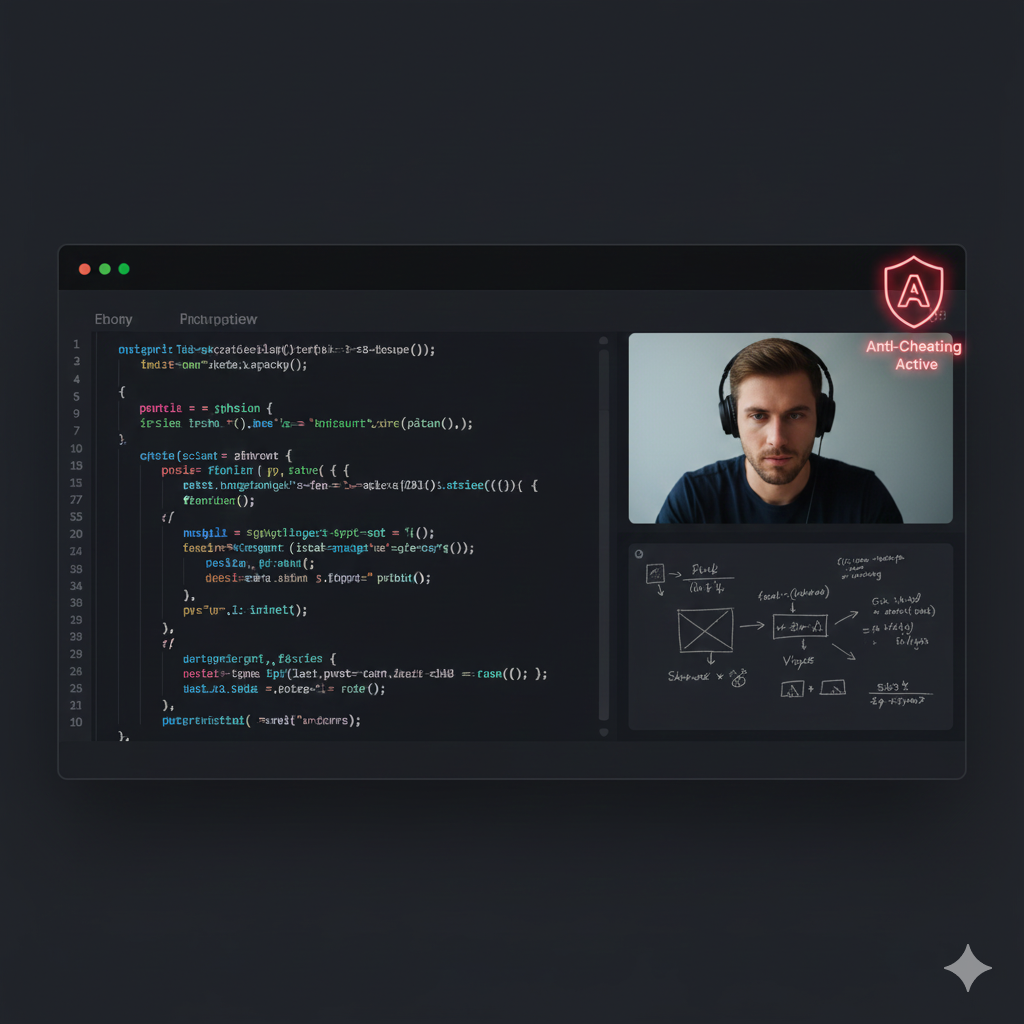

Where IntegrityLens fits

IntegrityLens AI is the first hiring pipeline that combines a full Applicant Tracking System with advanced biometric identity verification, AI screening, and technical assessments, so you can forecast capacity from one defensible system instead of stitching tools together. In a capacity model, IntegrityLens provides clean leading indicators like verified-qualified supply, review queue health, and interview completion telemetry. Used by TA leaders and recruiting ops to run the funnel, and by CISOs to set verification and fraud policies that finance can trust.

ATS workflow with stage timestamps as the planning spine

Identity verification in under three minutes (typical 2-3 minutes end-to-end: document + voice + face) before interviews

24/7 AI screening interviews to stabilize early-funnel throughput across timezones

Fraud detection signals with Evidence Packs for auditability

Coding assessments across 40+ programming languages

The weekly operating rhythm Finance should demand

A credible hiring forecast is updated weekly, uses leading indicators, and explicitly names the bottleneck. It also makes tradeoffs legible: if the business wants more hires next month, you can show whether the limiting factor is interviewer hours, verified candidate supply, or review capacity. Give recruiters access to their own funnel stats (democratized data) so they can fix bottlenecks before finance sees the miss. Then benchmark internally across teams and over time. Industry averages can be used as directional guardrails, but your own rolling history is what makes the forecast actionable.

What is the bottleneck this week, and how do we know?

How many verified qualified candidates do we have per open req, not just applicants?

What is interviewer slot supply next week after PTO and on-call coverage?

Is manual review queue age increasing, and what staffing or policy change addresses it?

Which assumptions are illustrative vs measured, and when will they be replaced?

Sources

- Checkr, Hiring Hoax (Manager Survey, 2025): https://checkr.com/resources/articles/hiring-hoax-manager-survey-2025

Pindrop, Why your hiring process is now a cybersecurity vulnerability: https://www.pindrop.com/article/why-your-hiring-process-now-cybersecurity-vulnerability/

SHRM, replacement cost estimates: https://www.shrm.org/in/topics-tools/news/blogs/why-ignoring-exit-data-is-costing-you-talent

Related Resources

Key takeaways

- Capacity is the minimum of two things: verified candidate flow and interviewer supply. Model both, then take the bottleneck.

- Use leading indicators (verified pass-through, no-show rate, interviewer hours) to forecast hires 2-6 weeks earlier than offer counts.

- Separate vanity metrics (applicants) from quality metrics (qualified and verified) to avoid overcommitting headcount plans.

- Fraud controls change capacity. The forecast must include manual review queues and step-up checks to prevent reviewer fatigue and surprise delays.

- Democratize funnel telemetry so recruiting and finance operate from one truth, not spreadsheets and anecdotes.

Produces weekly candidate throughput, interviewer slot supply, and a conservative hire forecast per job family.

Assumes ATS events and IntegrityLens verification outcomes are landed in a warehouse with consistent candidate identifiers.

Designed for auditability: every component is traceable to a measurable input (events, hours, conversions).

/*

Weekly Hiring Capacity Forecast

- Candidate-side throughput: verified qualified into interview loops

- Interviewer-side supply: available hours converted into loops

- Forecast hires: min(throughput, supply) * downstream conversion

Replace dataset/table names and filters.

*/

WITH params AS (

SELECT

DATE_TRUNC(CURRENT_DATE(), WEEK) AS this_week,

8 AS lookback_weeks

),

-- 1) Verified-qualified candidates per week (IntegrityLens + ATS)

verified_qualified AS (

SELECT

DATE_TRUNC(v.verified_at, WEEK) AS week,

a.job_family,

COUNT(DISTINCT v.candidate_id) AS verified_count,

COUNT(DISTINCT CASE WHEN a.stage = 'Qualified' THEN v.candidate_id END) AS verified_qualified_count,

COUNT(DISTINCT CASE WHEN v.review_required = TRUE THEN v.candidate_id END) AS review_required_count

FROM warehouse.integritylens_verifications v

JOIN warehouse.ats_candidates a

ON a.candidate_id = v.candidate_id

WHERE v.verified_at >= DATE_SUB((SELECT this_week FROM params), INTERVAL (SELECT lookback_weeks FROM params) WEEK)

AND v.status = 'VERIFIED'

GROUP BY 1, 2

),

-- 2) Interviewer hours available per week (from scheduling or staffing system)

interviewer_hours AS (

SELECT

h.week,

h.job_family,

SUM(h.available_hours) AS available_hours

FROM warehouse.interviewer_capacity_hours h

WHERE h.week >= DATE_SUB((SELECT this_week FROM params), INTERVAL (SELECT lookback_weeks FROM params) WEEK)

GROUP BY 1, 2

),

-- 3) Convert hours to interview loops (assumptions should be measured over time)

loop_assumptions AS (

SELECT 'software-eng' AS job_family, 4.0 AS hours_per_loop, 0.12 AS reschedule_rate /* illustrative */

UNION ALL

SELECT 'data' AS job_family, 4.5 AS hours_per_loop, 0.10 AS reschedule_rate /* illustrative */

),

slot_supply AS (

SELECT

ih.week,

ih.job_family,

ih.available_hours,

la.hours_per_loop,

la.reschedule_rate,

SAFE_DIVIDE(ih.available_hours, la.hours_per_loop) * (1 - la.reschedule_rate) AS loop_slots_supply

FROM interviewer_hours ih

LEFT JOIN loop_assumptions la

ON la.job_family = ih.job_family

),

-- 4) Downstream conversion from completed loops to accepts (measured rolling rate preferred)

downstream_conv AS (

SELECT

a.job_family,

0.35 AS loop_to_offer_rate, /* illustrative until measured */

0.70 AS offer_accept_rate /* illustrative until measured */

),

-- 5) Combine and take the bottleneck

capacity_forecast AS (

SELECT

COALESCE(vq.week, ss.week) AS week,

COALESCE(vq.job_family, ss.job_family) AS job_family,

COALESCE(vq.verified_qualified_count, 0) AS verified_qualified_inflow,

COALESCE(vq.review_required_count, 0) AS review_required_inflow,

COALESCE(ss.loop_slots_supply, 0) AS interview_loop_slots,

LEAST(COALESCE(vq.verified_qualified_count, 0), COALESCE(ss.loop_slots_supply, 0)) AS constrained_loops

FROM verified_qualified vq

FULL OUTER JOIN slot_supply ss

ON ss.week = vq.week AND ss.job_family = vq.job_family

)

SELECT

cf.week,

cf.job_family,

cf.verified_qualified_inflow,

cf.review_required_inflow,

cf.interview_loop_slots,

cf.constrained_loops,

dc.loop_to_offer_rate,

dc.offer_accept_rate,

(cf.constrained_loops * dc.loop_to_offer_rate * dc.offer_accept_rate) AS forecasted_accepts

FROM capacity_forecast cf

LEFT JOIN downstream_conv dc

ON dc.job_family = cf.job_family

ORDER BY cf.week DESC, cf.job_family;Outcome proof: What changes

Before

Finance forecasts were anchored to requisition plans and applicant volume. Interviewer availability was tracked ad hoc, and verification review load was treated as a support issue. Misses were explained after the fact, often with inconsistent definitions of "pipeline".

After

FP&A and Recruiting Ops adopted a weekly bottleneck forecast using verified-qualified inflow and interviewer slot supply as the primary constraints. Exceptions were documented via Evidence Packs, and manual review queues became a first-class capacity input.

Implementation checklist

- Define the source of truth for each stage: ATS, verification, interview platform, assessment engine

- Track stage-to-stage conversion and cycle time for the last 4-8 weeks (rolling)

- Inventory interviewer weekly hours by function and level (net of PTO and load)

- Compute slot supply (interview hours / hours per interview loop) and apply no-show and rework factors

- Compute candidate demand for slots (verified qualified candidates per week) and take the bottleneck

- Add governance: Evidence Packs for exceptions, approval flow for overrides, and a candidate appeal path

Questions we hear from teams

- Why not forecast from offers instead of earlier funnel stages?

- Offers are a lagging indicator. By the time offers slow down, you have already missed the window to add interviewer hours or staff manual review. Verified-qualified inflow and slot supply move earlier and give you time to correct.

- How do we prevent the model from turning into a spreadsheet fight?

- Lock sources of truth: ATS for stage movement, IntegrityLens for verification outcomes and Evidence Packs, and the scheduling system for completed loops. Use idempotent webhook ingestion so event counts are stable.

- What if interviewers refuse to commit hours?

- Then you do not have a hiring plan, you have an aspiration. Finance can require interviewer supply commitments as part of the budgeted headcount plan, just like any other resource constraint.

Ready to secure your hiring pipeline?

Let IntegrityLens help you verify identity, stop proxy interviews, and standardize screening from first touch to final offer.

Watch IntegrityLens in action

See how IntegrityLens verifies identity, detects proxy interviewing, and standardizes screening with AI interviews and coding assessments.